|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Home Equity Quotes: A Comprehensive OverviewWhat are Home Equity Quotes?Home equity quotes are estimates provided by lenders that indicate how much equity you can borrow against your home. These quotes are essential for homeowners looking to tap into their home’s value for various financial needs. How Home Equity is CalculatedYour home equity is determined by subtracting your outstanding mortgage balance from your home’s current market value. For instance, if your home is valued at $300,000 and you owe $200,000, your equity would be $100,000. Factors Affecting Home Equity Quotes

Benefits of Home Equity LoansHome equity loans offer numerous advantages, making them a popular choice for homeowners. They typically have lower interest rates than personal loans or credit cards, which can lead to significant savings over time. Uses for Home Equity Loans

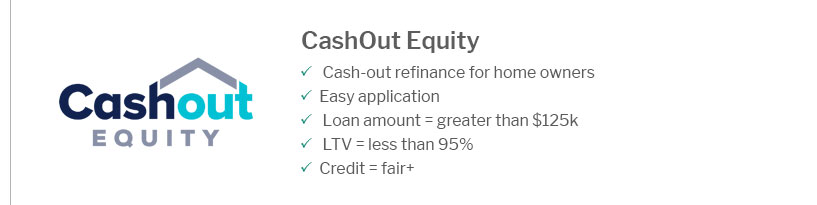

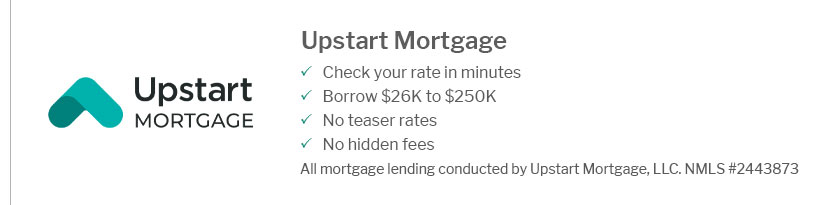

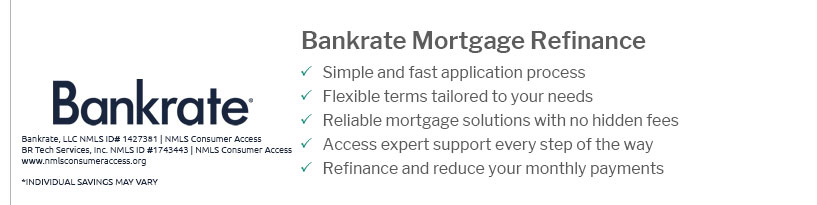

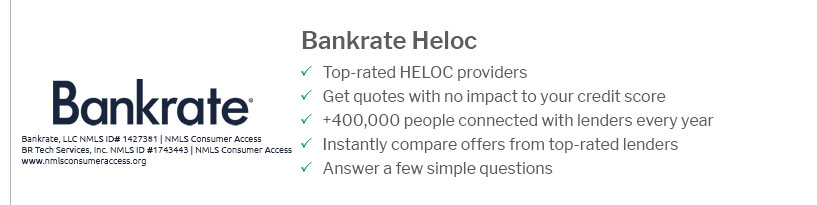

For those considering leveraging their home’s equity, exploring va interest rates can provide insight into potential borrowing costs. Choosing the Right LenderWhen seeking a home equity loan, it's crucial to select the right lender. Consider factors such as interest rates, customer service, and the lender's reputation in the industry. Exploring options from various second mortgage lenders can help you find the best terms tailored to your financial situation. FAQs About Home Equity QuotesWhat is a home equity quote?A home equity quote is an estimate of the amount you can borrow against your home’s equity. It considers factors like your home’s market value, outstanding mortgage balance, and current interest rates. How can I improve my home equity quote?Improving your credit score, reducing your existing mortgage balance, and enhancing your home’s market value through renovations can positively impact your home equity quote. Are there risks associated with home equity loans?Yes, if you fail to repay the loan, you risk foreclosure. It's important to consider your repayment ability before obtaining a home equity loan. https://better.com/home-equity-loan-rates

Home equity is an important financial asset for homeowners, as it represents the portion of the property that they truly own. It can be used as collateral for ... https://www.nerdwallet.com/article/mortgages/home-equity-loan-calculator

Home equity refers to the amount of your house you've paid off. Every time you make a mortgage payment or the value of your home rises, your ... https://www.loandepot.com/heloc

No obligation quote. Get a no-hassle online rate quote in minutes with no impact to your credit score. 2. Digital application. Go from apply to approved ...

|

|---|